Moses Babatope Explains the Economics and Revenue-Sharing Model of Film in Nigeria

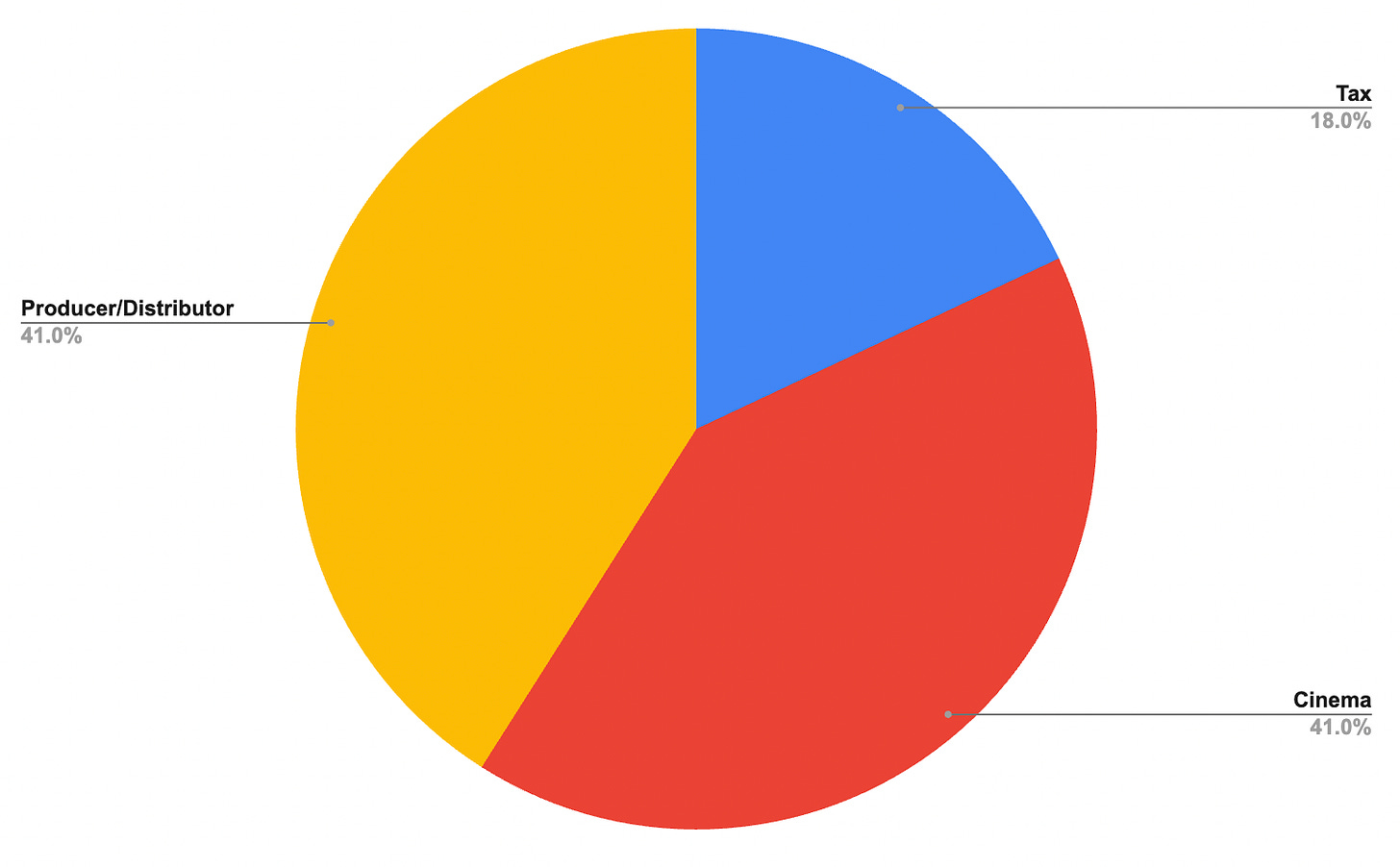

The breakdown indicates that about 13-18% is deducted for taxes alone. After cinemas take their cut, producers typically see between 30-40% of what’s left, with distributors also claiming a portion.

The buzz surrounding record-high revenue generation in Nigerian cinema, led by films from heavyweights like Funke Akindele and EbonyLife, has ignited a crucial dialogue about the profitability of Nigerian films and the requisite support structures underpinning this industry. Just last week, we reported that Nigerian cinema has hit a stupendous ₦7 billion in revenue so far in 2024, with projections to reach ₦10 billion by the end of the year. Yet, amid this success, the stark reality looms: a country with over 200 million people boasts barely 300 cinemas. In comparison, France, with a population of 68 million, launched 115 new screens in 2022 alone.

Moses Babatope, a cinema operator and co-founder of Filmhouse Cinemas and FilmOne Distribution—now the CEO of the Nile Group—explains the nexus between filmmakers, cinema operators, distributors, and the distribution of profits. He highlights the success of films like A Tribe Called Judah, which made history as Nollywood’s first film to gross over a billion Naira at the box office.

Moses paints a vivid picture: the film business is much like any other industry, a bustling marketplace filled with diverse players. Think of it as a supply chain—banking, agriculture, technology—each sector with its own unique dynamics. In the cinema realm, three key players emerge: Production, Distribution, and Exhibitors. Each of these entities plays an important role in the ecosystem.

After a film has been produced, on getting into ticket purchases and revenue sharing, the interplay between these players becomes evident. Cinemas invest heavily in creating inviting environments—state-of-the-art screen technology, sophisticated software systems, and thoughtfully designed viewing experiences. These investments are substantial and aim at providing audiences with an immersive experience that sets it apart from watching films on a phone or at home. Typically, such investments warrant a fair share of the revenue generated.

But cinemas aren’t the only players at the table. Distributors also have their hands full. Their responsibilities include ensuring that films are strategically positioned, properly launched, and effectively marketed. They manage financial reconciliations, ensuring that appropriate deductions are made while navigating the complexities of distribution. Then, there are filmmakers (producers, content creators)—who craft the stories and bring these films to life.

So, how is revenue shared among these stakeholders?

The answer is nuanced and could differ from film to film. However, for films like A Tribe Called Judah or other [Hollywood] blockbuster hits—the revenue split typically follows a 50/50 arrangement. However, the waters can get murky, often fueled by rumors and misconceptions. Many people are unaware of the multiple layers of taxes and deductions at play, which can significantly impact the net revenue that ultimately reaches the producers. Whether it’s VAT, entertainment tax, or withholding tax, these deductions can nibble away at profits, leaving producers feeling short-changed. After all, they are the creators of the content, and as the saying goes, “without the content, what is the business?”

This narrative often leads to cries of foul play, but it’s important to understand that this isn’t about deceit. Cinemas require ongoing investment in critical infrastructure to maintain a high-quality experience for audiences. Moreover, in a landscape where viewers have a myriad of entertainment options—from streaming services to cable TV—cinemas must continuously strive to up the ante and deliver value.

Now, let’s lay out the financials

When people hear that a film has grossed ₦1 billion, they often assume that this amount is lining the filmmakers' pockets. In reality, that figure represents total gross revenue, not net earnings. Moses’ breakdown indicates about 13-18% may be deducted in taxes alone. After cinemas take their cut, producers typically see between 30-40% of what’s left, with distributors also claiming a portion of that [the producer’s].

Credit: Creator Economy IQ

This complexity shows the delicate balance and relationships between all parties involved in Nigerian cinema. Each player has their interests and investments, making it important to understand this ecosystem to appreciate the broader picture of film profitability.